child tax credit portal not working

The amount increased from a maximum of 2000 per child to. Some taxpayers have been.

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

If you received advance payments of the Child Tax Credit you need to reconcile compare the total you received with the amount youre eligible to claim.

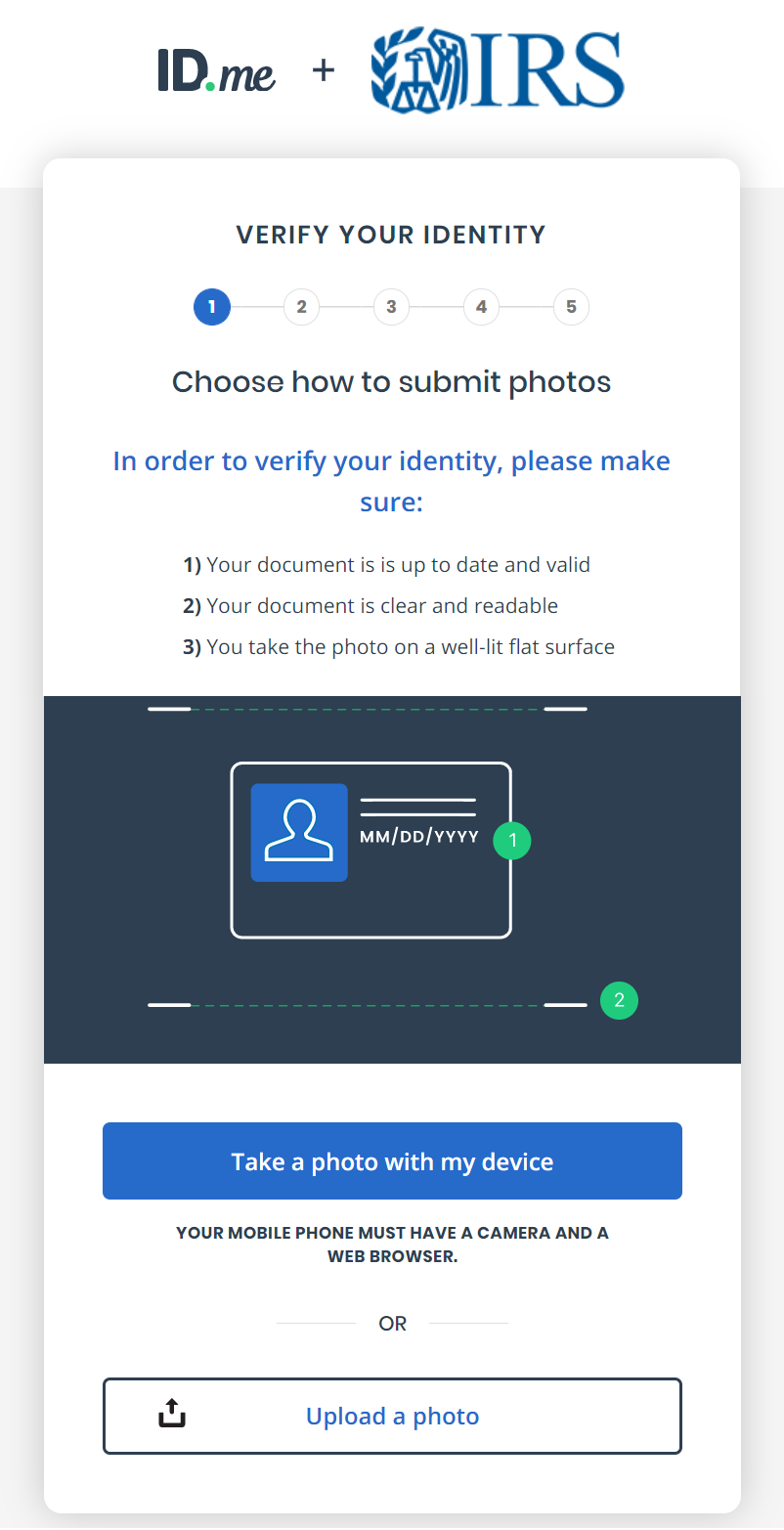

. You can no longer view or manage your advance Child Tax Credit Payments sent to you in 2021. The IRS has commissioned a third-party verification site IDme to verify your identity before you are. These payments up to 300 per month per child under age 6 and up to 250 per month per child age 6 through 17 will be paid in equal amounts and made no earlier than July 1 2021 and no later than Dec.

Its called the Non-filer sign-up tool which is for people who did NOT we repeat DID NOT file their 2020 taxes which would have been done in 2021. Already claiming Child Tax Credit. We file separately and its saying we owe 13.

Child Tax Credit portal not working. I cant even get into the portal it keeps saying unavailable and doesnt have my name just TAXPAYER and the little cloud crying. For tax year 2021 only ARPA increased the child tax credit amount to up to 3000 for each qualifying child between age 6 and.

The problem is if you want to claim a refundable tax credit you will need to fill out a form 1040. Child tax credit portal not working Tuesday March 1 2022 Edit Treasury Secretary Janet Yellen encourages Americans to take advantage of tax credits including the expanded Child Tax Credit and Earned Income Tax Credit in the South Court Auditorium on the. 2021 Tax Filing Information Get your advance payments total and number of qualifying children in your online account and in the Letter 6419 we mailed you.

At first glance the steps to request a payment trace can look daunting. These people can now use the online tool to register for monthly child tax credit payments. The child tax credit was changed significantly in 2021 making it fully available for the first time to the lowest-income families including those who typically do not have to file a tax return.

If you have at least one qualifying child and earned less than 24800 as a married couple 18650 as a Head of Household or 12400 as a single filer you. In order to sign in to any of the portals you will need to first verify your identity through IDme. Child Tax Credit portal not working.

The IRS is still dealing with a backlog of tax returns and it is possible a delay in processing your tax return has caused a delay in processing your eligibility for. I cant even get into the. This year americans were only required to file taxes if they.

Check mailed to a foreign address. 2 days agoThis year eligible families can use GetCTC to receive the 2021 Child Tax Credit expanded last year to 3600 per child 5 and under and 3000 per child 6 to 17. Making a new claim for Child Tax Credit.

The child tax credit ctc is also limited to your tax liability. Youll need to print and mail the. If you paid taxes in 2019 or 2020 then the portal you will use is here.

What To Do If The IRS Child Tax Credit Portal Isnt Working Finding the portal. Enter your information on Schedule 8812 Form. The IRS has partnered with the third-party company to verify identities.

The Child Tax Credit Update Portal is no longer available. Get your advance payments total and number of qualifying children in your online account. We got the child tax credit and have two kids over 6.

Millions of families who werent required to file a federal tax return but are still eligible for the Child Tax Credit or missing stimulus payments from last year can finally claim those tax benefits starting this week. Are parents who took the child tax credit typically having to pay back in. The IRS has created specific online portals for updating your personal information and managing the Child Tax Credit payments that began being distributed on July 15.

The irs has opened an online site to enable taxpayers to unenroll from receiving advance payments of the 2021 child. Child tax credit portal not working. The new child tax credit update portal allows parents to view their eligibility view their expected ctc advance payments and if they wish to do so unenroll from receiving advance payments ie to opt out.

The child tax credit ctc is also. The amount you can get depends on how many children youve got and whether youre. 2 days agoPeople can also get any pandemic stimulus payments they are still owed through the portal.

To reconcile advance payments on your 2021 return. The widget was created for low-income families those earning less than 12400 individually and 24800 for couples who arent required to file a. Posted by 2 months ago.

And towards the end of this post we will walk through step-by-step what you need in order to. But if you have more than 2500 of earned income some or all of it is usually given back to you thru the additional child tax credit.

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Sharepoint Implementation With Social Intranet Portal Sharepoint Sharepoint Intranet Social

We Are Organising The E Meeting Google Hangout Meet On Issues In Reconciliation Of Gst Input Tax Credit To Rec Tax Credits Reconciliation Google Hangouts

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Upload Gst Returns On The Portal To Avail Past Input Tax Credit Kerala Hc Tax Credits Business Software Kerala

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Invoice Registration Portal Process Benefits Mode Of Registering In E Invoicing Portal Government Portal Invoicing Registration

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Provisional Itc Credit On Gst Portal ज एसट प र टल पर प र व शनल आईट स Tax Credits Portal Credits

Exporting Payment Transactions From E Payment Report In Tally Management Information Systems Profit And Loss Statement Best Accounting Software

Why Choose Solar Solar Energy Design Solar Energy Renewable Energy Technology

E Way Bills Portal Portal Portal Website Register Online

How To Register Associate Dsc Of Director Partner On Mca V3 Portal In 2022 Mca Director Association

Let S Start With The Basics Of A Tax Return Filing Taxes Income Tax Tax Services

Pin By The Taxtalk On Income Tax In 2021 Capital Gain Capital Assets Investing